We examined a variety of taxes.We took advantage of it and thought about the future.

We examined a variety of taxes.We took advantage of it and thought about

the future.

| Consumption tax will rise to 10% in 2019, do you think that taxes will increase from now? |

I thinkthat it will increase. An increasing number of elderly people because I think do I need to pension increases minute. |

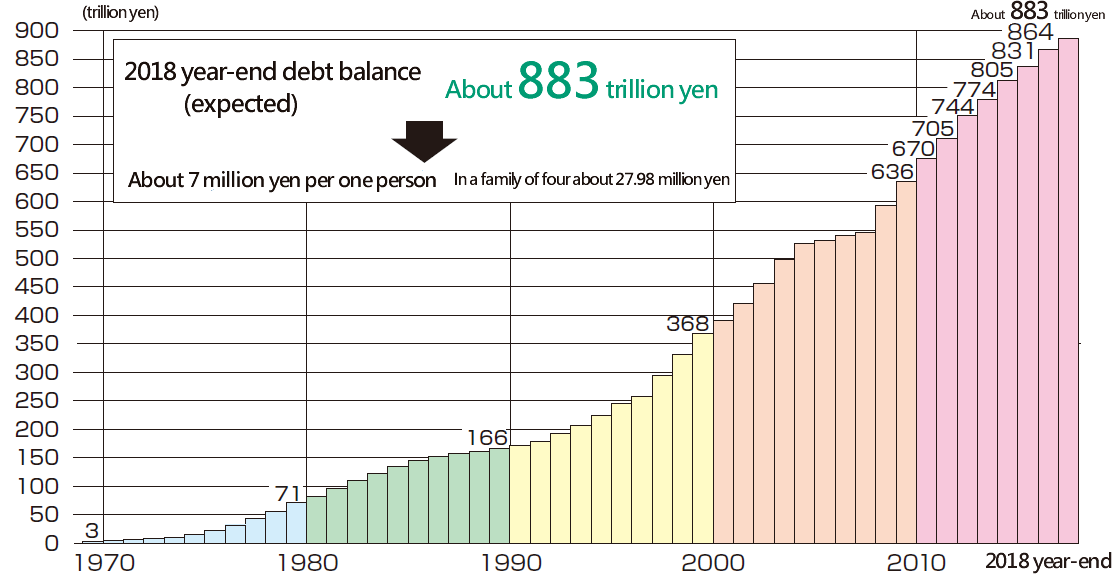

I thinkthat it will increase. It is because we have to pay debts of about 883 trillion yen at present. |

I think that it will increse. I think that Japan will become near future, so I think money will become necessary accordingly. |

I thinkthat it will increase. I think that I will raise the tax because I am using taxes raised for Japan so far. |

|

I think that it will increase. Actually,from1stOctober2019,the tax rate will increase to 10%, but I think that it may be going up to 11% if the declining birthrate and aging population advances. |

![]()

| What do you think will go with the use of tax? | ||

I think that we will use it mainly for welfare. Instead, I think that things for young people will decrease. |

I think that it will be used about public services and educational matters in the same way as before. |

I think taxes will follow the most ones. |

I think that it will be taxed in various places. |

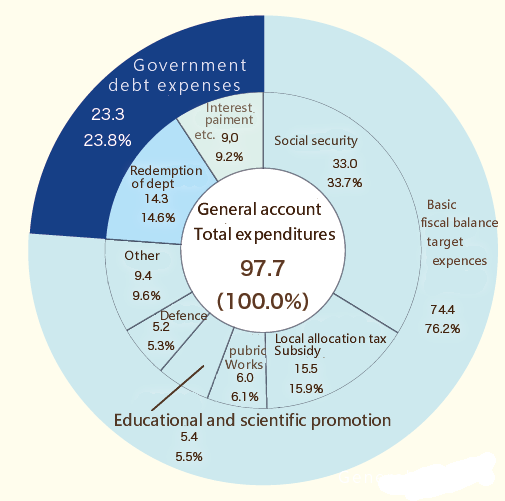

<Breakdown of Japanese general account budget for Heisei 30 years> |

Since the National Assembly will decide from now, I do not know the details.However, I think that if the tax is small relative to the number of citizens, disasters can not be assisted. |

| What do you think going to deal with the country's debt? | ||

I think that I will make payment little more or make sure that debt will not increase. |

I think that I will discuss with the Diet members and think again of the people and repay the debt. |

|

Conclude in the Diet while listening also public opinion I think can I began to deal with the debt of Japan. |

<Exhibition Heisei 30 fiscal year Mie Prefecture version "What is tax?" Issued by the Nagoya Regional Taxation Bureau> |

Japan is a country with a lot of debt and it is also a future issue for Japan.With the declining birthrate and the aging population progressing, I think that it is important to increase the income of the country in Japan and to reduce the expenditure of the country. |