Hey tax!

〜 Kind of taxes 〜

This is the tax that is the most imminent for our consumers.It is taxed for most business to be carried out in Japan.

Breakdown of 8% of consumption taxes

National tax 6.3%+ local consumption tax 1.7% = 8%

For finance reform, there was the movement that I was going to introduce "general excise tax" into.However, the government was not able to readily introduce it because the nation objected.

April, 1989 consumption tax rate 3%

April, 1979 consumption tax rate 5%

April, 2014 consumption tax rate 8%

October, 2015 consumption tax rate 10%

(postponement examination)

The country where has high tax rate of the world consumption tax (value added tax).

The tax rate in Japan looks low when I examine only consumption tax rate. However, in most of the developed countries, I distribute a tax rate with daily necessities such as the food and the product except it and set it.The Eastern European countries such as Sweden have very high tax rate.In those countries, social welfare is substantial than Japan.Therefore the nation does not complain to a high tax rate.

This is a consumption tax to be levied on alcoholic beverages.The tax rate is fixed according to a kind and the item of alcoholic beverages, alcohol levels.

For example, of approximately 200 yen, among can beer, 77 yen is a tax (350 ml).

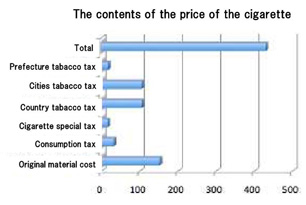

The cigarette tax has country cigarette tax, local cigarette tax, three kinds of the cigarette special tax.

For example, among products of one 410 yen, cigarette tax, approximately 20 yen are consumption taxes approximately 245 yen. 265 yen is a tax.

A cigarette tax of Japan is still low one in developed countries. Japan is approximately 65% of tax rates, but the country of 85% of highest tax rates is Denmark.

This is taxed for constant liquefied natural gas.Gas for fuel used for a vehicle for business such as taxis becomes taxable mainly.

Tax rate is 17.5 yen per kg ( about 9.8 yen per little).

This is taxed to "crude oil" "gaseous hydrocarbon" "coal" gathered in the country.In addition, these are taxed for "crude oil" "oil products" "gaseous hydrocarbon" "coal" taken over from the bonded area

Furthermore, "the exception of the tax rate of the oil coal tax for global warming measures" is established and is carried out progressively from October 1, 2012.

This is the verge where I shipped volatile oil from the yard to and a tax to be levied when I imported it.Gasoline becoming the fuel of the car corresponds to this mainly.It is affected by resources of the road maintenance. Volatile oil tax + district road tax = gasoline tax

This is the tax that a document made about economic business costs.It sticks a bill, a receipt, the predetermined stamp including the stock certificate and a postmark is to do it and puts a tax.

When we build land and the building and purchased it, we do the proprietary rights preservation registration or registration of a transfer.This tax that it costs when I register it is registration and license tax.

This is a tax to be imposed on me to volatile oil.I check it with a volatile oil tax and declare and am paid and am affected by resources of the road maintenance.

Volatile oil tax + district road tax = gasoline tax

For the electricity which an electric power company sells, it is a tax to impose according to a consumption. It is allotted for the setting promotion of generation facilities, facilitation of the driving, ensuring safety, facilitation of the electric supply.This is included in the electric bill that the nation pays every month.

This is a tax to be levied on a domestic trade and the import business such as sale or the service of the product. In 8% of consumption taxes, 1.7% of local consumption tax is included

The business person of the golf course pays this. 70% of golf course use taxes are things of the local authority where a golf course is located.

It is a tax to be usually imposed on me in freight via the border by the government of the import country.It is aimed for the protection of the domestic industry mainly.

When we purchase articles more than the amount of uniformity abroad and bring it into the country, it is necessary to report purchased amount at the time of entry.

For the foreign trade ship which entered the opening of a port, it is a tax to impose the net tonnage of the ship as a standard of assessment. For the ship which entered port in the unavoidable accident including the sea disaster, I am not taxed.