Role of the Bank

This image was created by a team member

What is a Bank?

What do you think of when you hear the word "bank"? I think most people think of "a place to deposit money.

Correct. However, it is only part of the function.

In addition to this, banks have other important roles to play.

Here we would like to introduce the role and types of these banks.

Role of the Bank

There are two major roles for banks, and within each of these roles, they are again divided into two parts.

Role as an economic and social center

We keep the money and manage it."

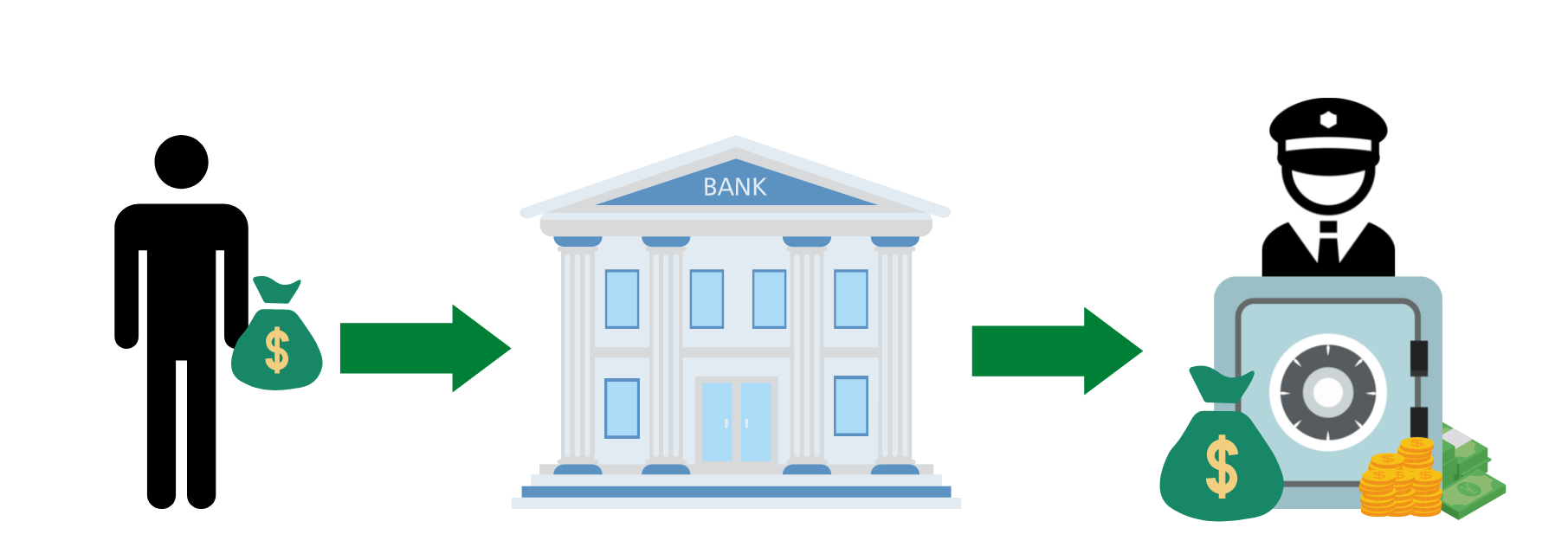

This image was created by a team member

This is the most commonly known business of banks. Users deposit their money and the bank keeps it.

Money deposited in a bank is called a "deposit.

*What is the difference between a "deposit" and a "savings account"? Have you ever wondered what the difference is between a "deposit" and a "savings account"? The difference is that the designation changes depending on the financial institution where the deposit is made.

- Financial institutions referred to as "deposits": banks, credit unions, credit associations, labor banks, etc.

- Financial institutions called "savings": Japan Post Bank, JA Bank (agricultural cooperative), JF Marine Bank (fishery cooperative), etc.

The deposit taker avoids the risk of fire and theft and saves the cost of installing his or her own safe and security system. The bank benefits by using the deposits to make loans to businesses, for example.

The deposited money is then returned to the depositor with interest, but in the meantime the deposited money is kept safe and managed.

We offer an operational method called "money deposit."

As the bank invests the deposits, it makes a profit and then returns the funds to the depositors with interest on the deposited money.

This can be said to be providing depositors with a means of managing their money in the form of deposits.

Role as the center of social infrastructure

"Loaning out money."

Deposits placed with banks are lent to individuals, companies, and national and local governments that need the money.

Individuals, companies, etc. that borrow money pay interest to the bank. This is a loan.

Settle your money."

Banks provide payment by wire transfer, drafts, checks, and electronically recorded notes, as well as account transfers for utility bills, credit card bills, etc. This function allows depositors to avoid the time and effort associated with making and receiving payments, and the risk of theft associated with transporting cash. This function allows depositors to avoid the time and effort required to make and receive payments, the risk of theft associated with transporting cash, and the ability to promptly transfer funds, even to distant locations.

Banks streamline economic activity by providing a means of payment settlement.

Types and Differences of Banks

Banks are not just one type of bank.

It is also subdivided into smaller categories within the larger grouping of banks.

megabank

Although the name "megabank" sounds cool, simply put, it is a "large bank with a national scope of operations.

Although there is no clear definition of the size of operations or amount of revenues, the following three are generally referred to as the three mega banks.

- Mizuho Financial Group: Owns Mizuho Bank and Mizuho Trust & Banking

- Mitsubishi UFJ Financial Group: Owns Mitsubishi UFJ Bank and Mitsubishi UFJ Trust and Banking Corporation

- Sumitomo Mitsui Financial Group: Has Sumitomo Mitsui Banking Corporation and SMBC Trust & Banking Co.

I am sure you have heard of all of them at some point.

Although megabanks are large in size and have a wide range of operations, there are no major differences in the operations of the various groups.

regional bank

Regional banks are ordinary banks that have their head office in each prefecture and operate in a specific region. They are characterized by the fact that their purpose is to contribute to and develop the economy of a specific region.

メガバンクが集団塾、地方銀行が家庭教師、そのような認識です。

trust bank

Trust banks, like other banks, are established under the Banking Law, but conduct their business under the "Law Concerning Engagement in Trust Business by Financial Institutions.

- Trust businessManagement and administration of assets held by individuals and corporations using the "trust" system.

- Concurrent BusinessesVarious businesses related to the management and disposal of property, such as inheritance-related services such as the custody and execution of wills, stock transfer agency services to manage corporate shareholder registers, real estate brokerage, etc.

A bank that can perform the above services is referred to as a "trust and management financial institution".

net banking

It is like an e-commerce site for banks. It does not have a face-to-face storefront, but provides services over the Internet. Both statement inquiries and transfers can be made over the Internet.

Actual cash deposits and withdrawals are made at convenience stores and affiliated bank ATMs.

Summary of the Bank's Role

This image was created by a team member

We have learned about the two roles and types of banks.

There will come a time in your future life when you will make use of the bank.

Those of you who want more in-depth knowledge, learn on your own!

Also, the banking industry is changing every day, and someday new technologies may be created and lost.

It can happen that way.

It is not limited to changes in banking alone.

What is required of high school students today is the very ability to adapt to such changes.

before next