bond

This image was created by a team member

What is a bond?

In a nutshell, bonds are "securities issued by a company or country to borrow funds from investors.

The bond has a fixed maturity date and the face value is paid upon reaching maturity.

In addition, the investor receives interest in exchange for lending money.

Since bonds are securities, they can be sold without reaching maturity.

As such, it is a more stable asset than stocks or real estate.

The surface interest rate, issue price, and maturity date of the bond are determined in advance.

- The face value is the amount paid at maturity. It is the minimum transaction unit.

- The surface interest rate is the percentage of interest paid on the face value. It is determined at the time of issuance and, in principle, remains unchanged until maturity.

Also called "coupon rate. - Issue price is the price at which a bond is issued. It is expressed as an amount per ¥100 of par value.

- The redemption date is the date on which the par value of the bond is to be redeemed.

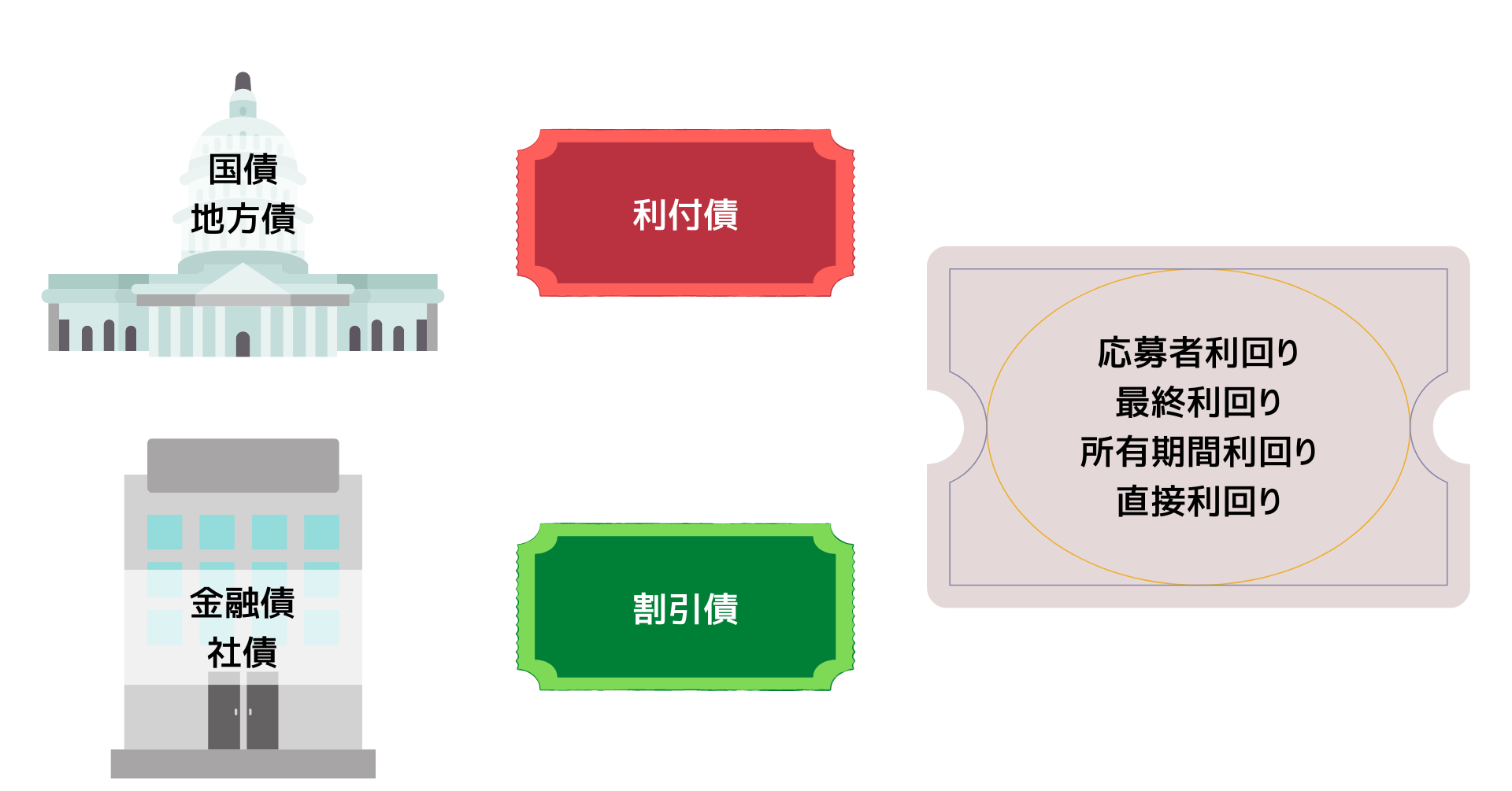

Bond Classification

Classification by Issuer

Bonds are divided into two major categories, which are further subdivided into two categories.

government bond

- Government bonds: bonds issued by the government

- Municipal bonds: bonds issued by local governments

private debt

- Financial bonds: bonds issued by certain financial institutions

- Corporate bonds: bonds issued by general companies

Classification by Interest Payment Method

- Interest-bearing bonds: Bonds that pay interest periodically.

- Discount bonds: bonds issued at a discount in exchange for no interest payments

4 Yields on Bonds

- Applicant Yield: Yield if the bond is purchased when newly issued and held until maturity.

- Final Yield: Yield when existing bonds are purchased at market value and held until maturity

- Holding period yield: Yield if the bond is not held at maturity but sold in the middle of the term.

- Direct Yield: Yield that looks at how much interest is earned each year on the purchase price.

This image was created by a team member

Bond Ratings

Although bonds are relatively safe instruments, interest payments may be delayed or redemption of the face value may cease due to the deterioration of the business of the company issuing the bonds.

The rating of such risk is called the credit risk (default risk) of the bond.

Ratings are denoted by symbols such as AAA (triple A) and BB (double B).

Bond prices fall when the rating falls.

Bond Summary

You may not have an image of bonds because you are not in contact with them on a daily basis nearly as often as you are with stock or real estate investments.

However, the fact that many people do not have a clear picture of what is going on means that they can develop money literacy that is superior to others just by having this knowledge.

Of course it is better to know about bonds than not to know about them.

Let's broaden our investment horizons a little and expand our future possibilities!

before next