equity investment

This image was created by a team member

as a general rule

Buying a stock" simply means that you are buying the company and lending money to it.

Stock prices (the price of a stock) vary from company to company, with prices fluctuating according to supply and demand.

The number of shares issued can be determined by each company, and the number of shares issued x the share price is called the "market capitalization. This is an important term to keep in mind.

And what we must always know in price fluctuations is that most of the shareholders are institutional investors and that the stock price is an indication of how the company will look in the future.

*Institutional investors are corporations such as investment companies and governments.

Investors buy shares to predict the future of the company.

Therefore, just because a company's performance is good now does not necessarily mean that its stock price will rise or that its stock price will rise because it is prospering now.

What is Stock Investment?

Stock investment is an investment method in which you purchase shares issued by a company to earn dividends, special benefits, or trading profits.

In Japan, cash and deposits currently account for more than 50% of households' financial assets, while stocks (including investment trusts) account for about 14%. (From "Japan-U.S.-Europe Comparison of Flow of Funds," Research and Statistics Department, Bank of Japan, August 20, 2021)

How do you feel about these figures?

Let us now compare this with the U.S., a major economic powerhouse.

In the U.S., cash and deposits account for about 13%, and stocks account for about 50%.

As can be seen in comparison with the U.S., Japanese people have a very small share of household financial assets in stocks.

The reason why there can be such a difference between Japan and the U.S. is because, as we learned in our money education, the idea that "investment = bad and dangerous" remains strong in Japan.

To dispel this notion, one must learn more about investing.

Investment = Evil and Dangerous" is wrong!?

Why are investments considered "dangerous" or "risky"?

That's because the asset could be reduced, right?

However, the risk can be minimized by managing the risk.

The first is to diversify your investments, as we learned in the previous section.

Second, research and analyze the company you are buying from.

Companies listed on the stock exchange must disclose their financial results.

By reading and analyzing the growth rate, future potential, and financial condition of the company from its performance, we can maximize risk.

Shareholder Rights

A person who owns shares is called a shareholder.

Its shareholders have three main rights.

It is.

- Voting rights: Rights to participate in management at general meetings of shareholders

- Right to claim dividend: Right to receive distribution of surplus from the company

- Right to claim distribution of residual assets: Right to receive the remaining assets in the event of dissolution of the company

These rights protect shareholders.

Reorganization of the Tokyo Stock Exchange

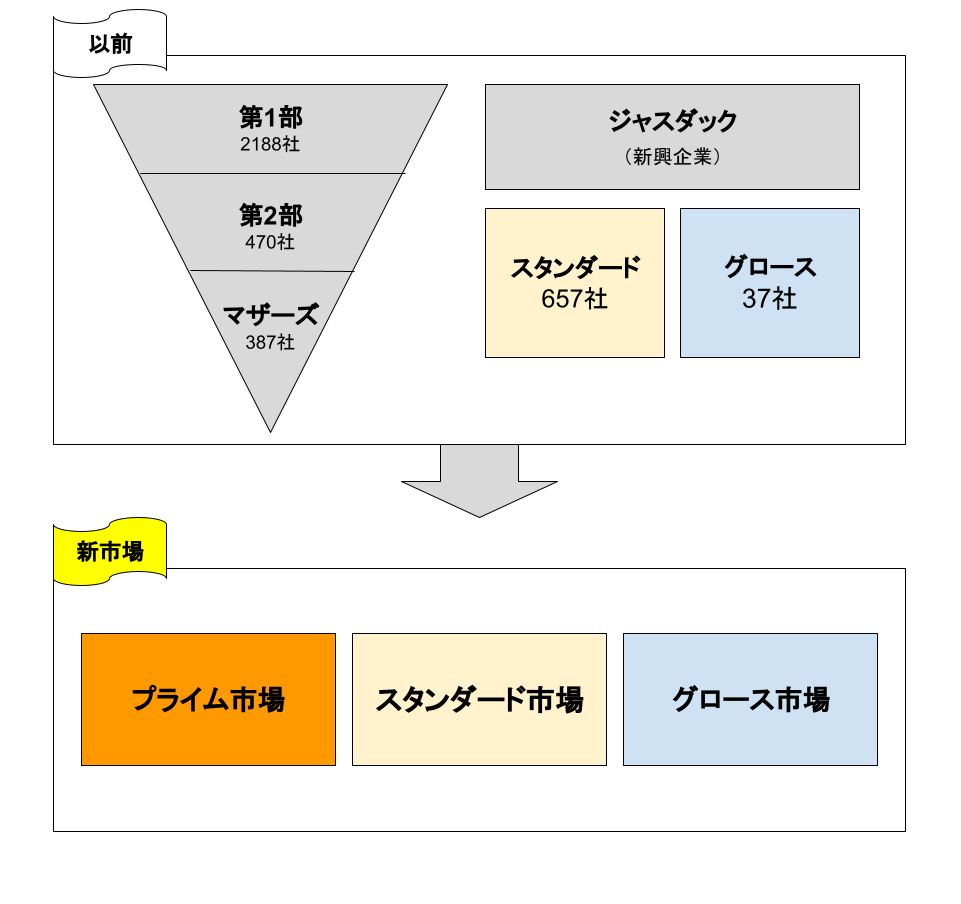

Effective April 4, 2022, the Tokyo Stock Exchange market has been reorganized.

See image below.

This image was created by a team member

This image shows the "Current Market" and "New Market" of the Tokyo Stock Exchange.

Previous markets: 1st, 2nd, Mothers, Jasdaq (Standard, Growth)

There is a market called

That market has been changed and consolidated into three new markets: Prime, Standard, and Growth.

Until now, the number of companies has increased because the conditions for listing on the First Section are loose and delistings are not very common, and the number of companies has ballooned to the point where they account for 60% of the total number of companies.

Therefore, as a measure to stimulate Tokyo Stock Exchange investment activity, the market was consolidated and the best companies were narrowed down.

Finally.

By investing in stocks, money goes around to companies, stimulating the economy and creating a better society.

In other words, stock investment is essentially an important act to revitalize the economy.

It's not gambling, and it's not bad for personal gain.

I don't tell everyone to invest in stocks.

However, I hope that the impression of stock investment will improve even a little.

before next