About Investment

This image was created by a team member

What is Investment?

Investment, in a nutshell, is "investing one's capital with the expectation of profit from a medium- to long-term perspective.

Examples include the purchase of "mutual funds," "individual bonds," and "stocks.

However, unlike deposits, investments do not guarantee the principal, so there is a risk of loss of principal (loss of invested money).

With that risk comes a greater return.

Specifically, the annual yield on deposits is about 0.001~0.01%, whereas the annual yield on investments is realistically about 10%.

This is why investments are considered high-risk, high-return.

But the risks can be minimized. Let's learn how to do that as well.

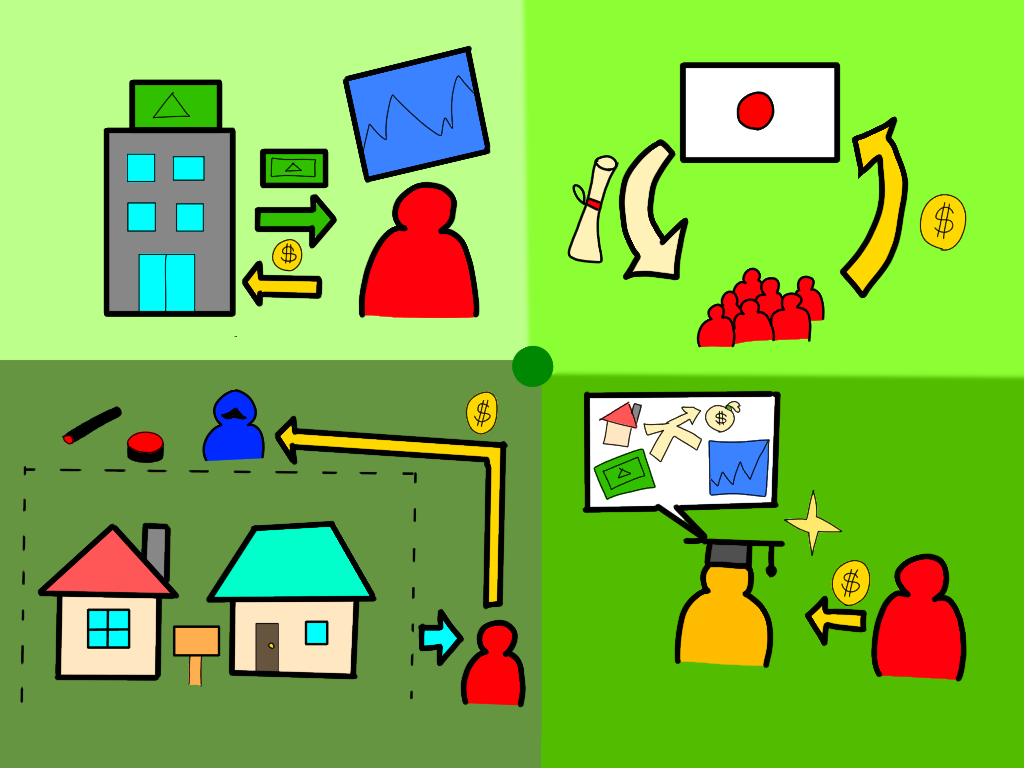

Type of Investment

stock (company)

You will learn more about stocks in a later section.

Here, you can think of it as "the buying and selling of share certificates issued by a company.

real estate

You will also learn more about real estate in a later section.

Here, you can think of it as "the buying and selling of real estate such as land and buildings.

Government and corporate bonds for individuals

Individual government bonds and corporate bonds are collectively referred to as bonds.

You will learn more about bonds in a later section, so here you can think of it as the buying and selling of bonds (certificates that you want to borrow money) issued by the government or a company.

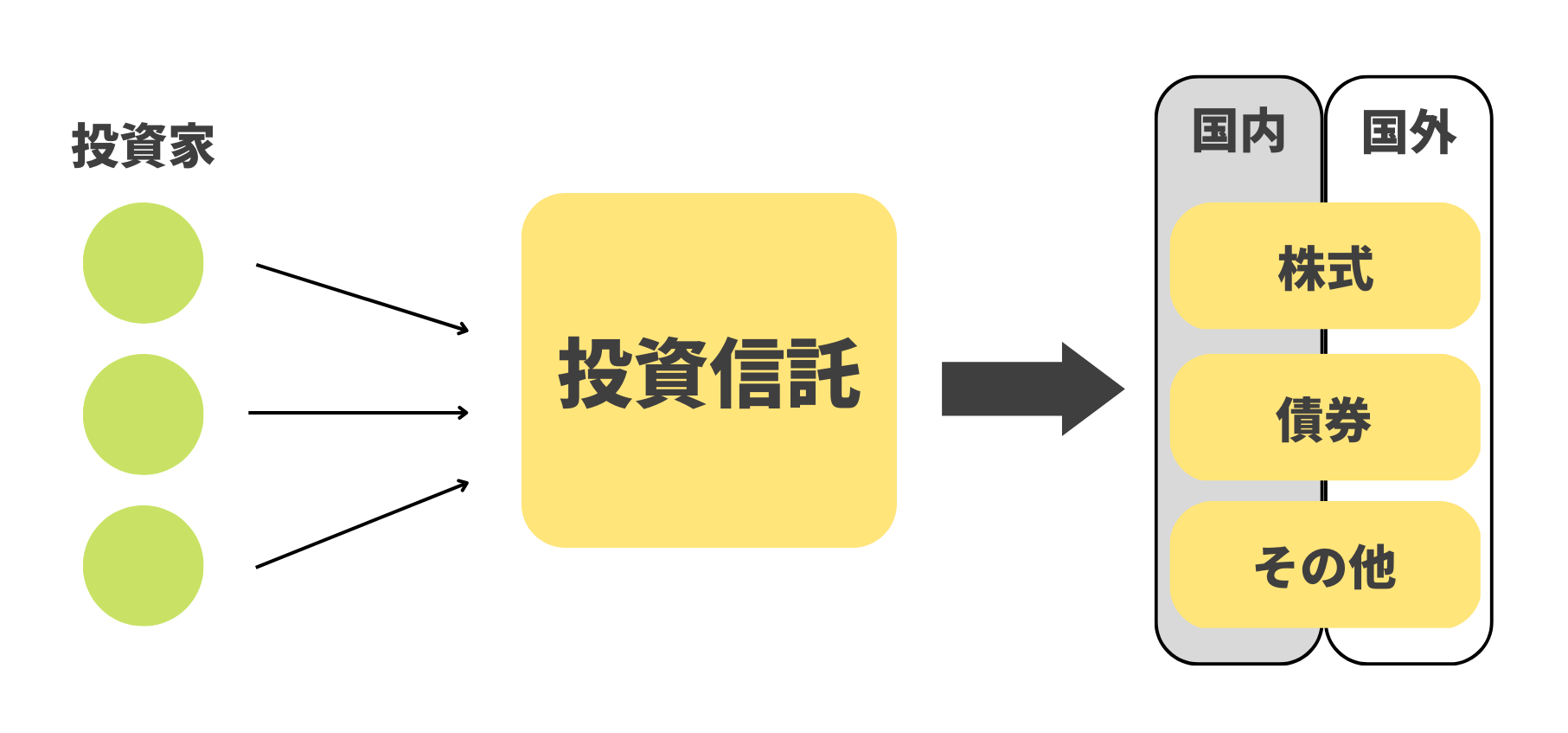

Investment trust (fund)

This image was created by a team member

Mutual funds are "financial products in which money collected from investors is invested and managed by investment professionals on their behalf.

Advantages/Disadvantages

Advantages

- You can start with a small amount.

- Relatively stable.

- You can choose your own investments.

Disadvantages

- Trust fees and other fees are charged.

- The returns are not that great.

- The liquidity is low and money cannot be withdrawn immediately.

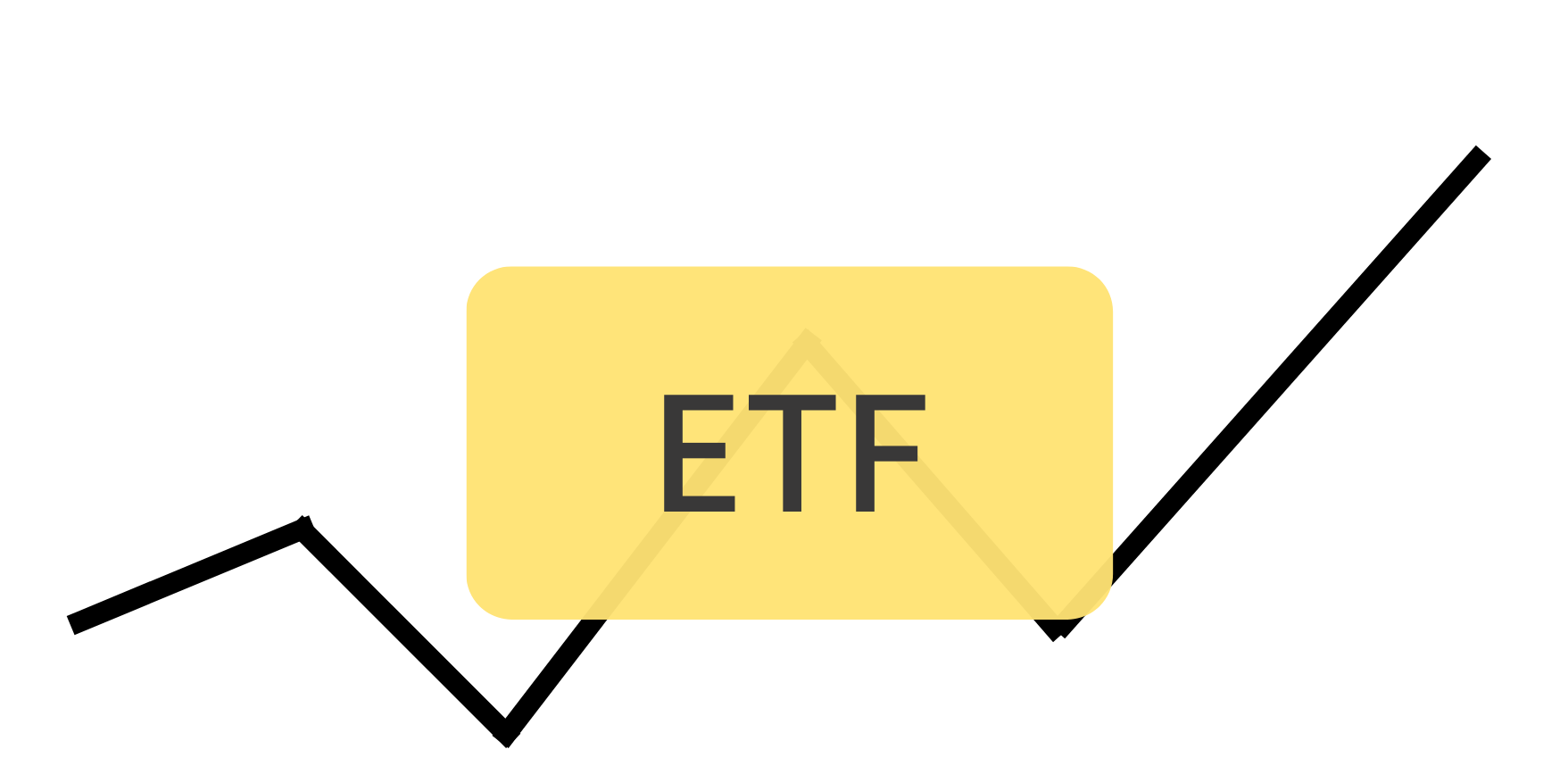

ETF (Exchange Traded Fund)

This image was created by a team member

An ETF (Exchange Traded Fund) has the same mechanism as a mutual fund, but with an ETF, you can choose stocks listed on a stock exchange.

Therefore, it is characterized by the ability to perform margin transactions, etc., just like stocks and other securities.

Advantages/Disadvantages

Advantages

- Real-time transactions can be made on the exchange.

- Easy to diversify investments.

- Costs are lower than those of a typical mutual fund.

Disadvantages

- It takes time and effort to reinvest distributions.

- Higher risk in margin transactions.

FX (Foreign Exchange Trading)

This image was created by a team member

Forex (currency trading) is an investment method that takes advantage of the difference in value between currencies (currency exchange).

Advantages/Disadvantages

Advantages

- Large returns can be achieved due to high volatility.

- You can start with a small amount.

- Trading is possible 24 hours a day on weekdays.

Disadvantages

- High risk due to large fluctuations.

- It requires knowledge of world interest rates, chart analysis, and much more.

- Leverage can cause large losses.

*Leverage is a mechanism that allows a large multiplier to be applied to the amount invested to increase the principal amount and improve the efficiency of profits.

gold

This image was created by a team member

Gold investment is an investment method that takes advantage of the scarcity of gold and differences in price fluctuations due to demand, supply, and other factors.

Advantages/Disadvantages

Advantages

- Inflation-resistant.

- Fluctuations are relatively stable.

- Value standards are the same worldwide

Disadvantages

- You can only aim for capital gains.

- Commission fees are relatively high.

Crypto assets (virtual currency)

Crypto assets (virtual currencies) are explained in detail in "Virtual Currencies," so you only need to know the name here.

Income Gains and Capital Gains

When you start investing, you must understand income gains and capital gains.

Income gains are profits that can be received on a regular and continuous basis, such as dividends and rental income.

Since income gains are unearned income, increasing the amount can bring you much closer to financial freedom.

What is capital gain→ In a nutshell, it is the profit made when buying and selling.

If you make a profit from the difference between the value at the time you bought it and the value at the time you sold it, that is a capital gain.

The investor's profit is composed of income and capital gains.

Risk Management in Investment

As mentioned in the introduction, investments are said to be high-risk, high-return.

However, risk can be minimized through good risk management.

So how do we manage risk?

It is a diversified investment.

Diversification is a method of managing risk by diversifying your investments across multiple investments.

For example, by separating investments in stocks into information and communication stocks and manufacturing stocks, if one industry goes down and the other goes up, the risk is spread out, isn't it?

This has a risk-reducing effect the more objects you diversify.

The previous example was only in equities, but combining equities and real estate, or bonds and real estate and equities, is also good risk management.

However, too much diversification can be difficult to manage, so it is a good idea to diversify your investments to the extent possible.

Other risk management is to invest the extra money in your life.

I think it is a good idea to invest all the money you have, but the risk is higher.

For example, the stock market may crash and you may not be able to make a living.

At such times, the risk of losing one's livelihood is eliminated by having one's living expenses securely in the bank or in cash.

It also allows for new funds to be invested in the event of a major crash.

Therefore, when investing, it may be possible to manage risk well if extra money is invested with living expenses left on hand.

Finally.

This image was created by a team member

Investment is not a must.

Risk management does not reduce risk to zero.

Therefore, I would like each individual to make an investment based on his or her own judgment after considering the risk and return.

We hope that you have some interest in investing.

before next