Obligation to pay taxes

Current situations

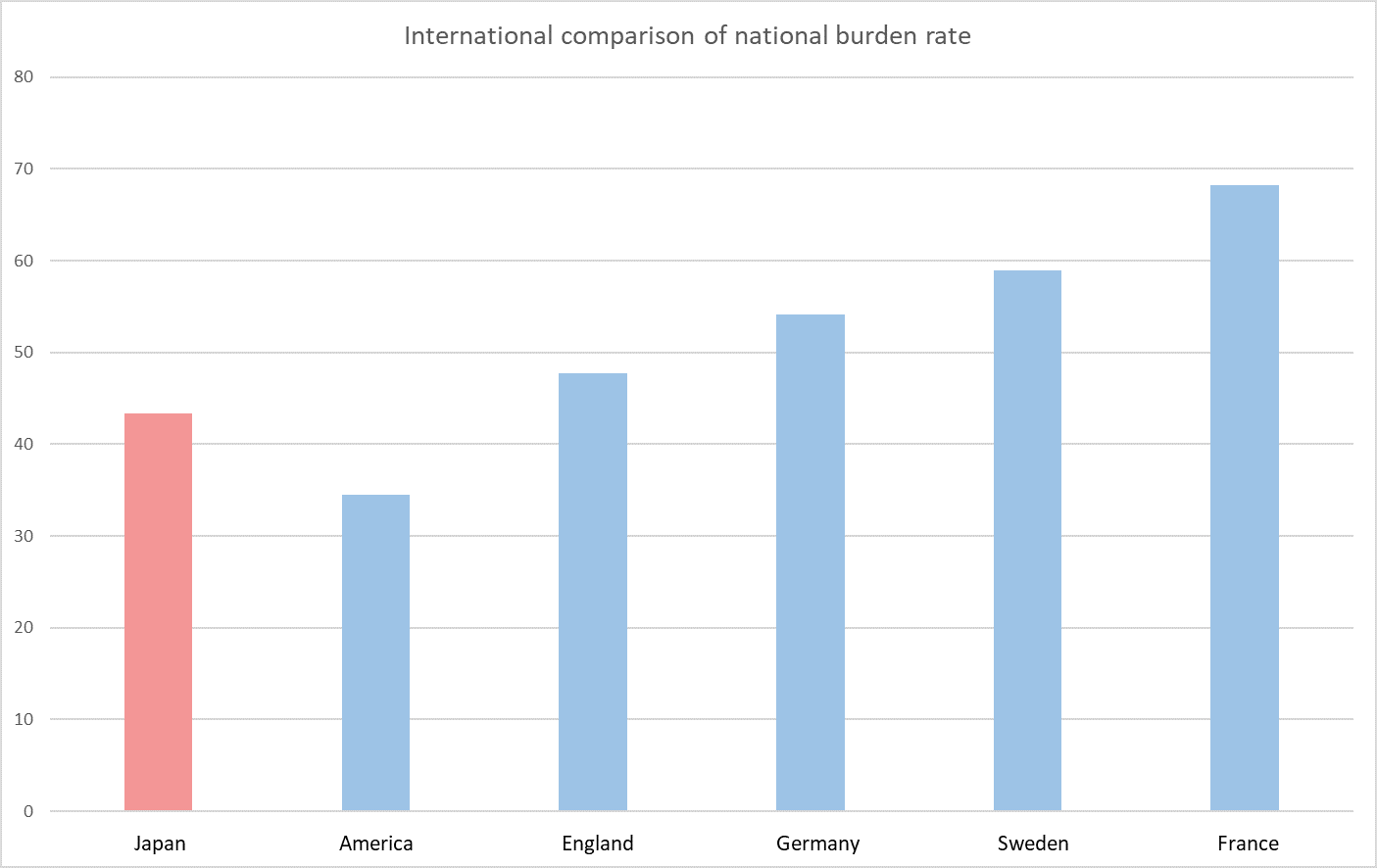

National burden rate

The national burden rate indicates the ratio of taxes and social security burdens such as pensions, health insurance, and long-term care insurance occupy in national income.It was announced that this national burden rate will reach a record high of 44.6% from the new fiscal year.

In France, where the national burden rate rate is high, the consumption tax rate is 20%, which is very high, but this allows people to receive excellent social welfare services, making it a "high welfare, high burden" country.

Although Japan's national burden ratio is higher than that of the U.S., it is relatively low when viewed in the context of all developed countries, so it can be described as "medium welfare, medium burden."

We consumers tend to think that the public burden ratio is the percentage of taxes borne by consumers, so the lower the better, but we cannot assert that in a straightforward manner.

This is because the lower the burden, the less money is available for public services such as social security.

When it becomes so, for example, that if you have a serious illness, you may have to pay a large amount of money out of your own pocket because you are not covered by the medical insurance system.

It is a very difficult question whether it is better to have a high burden but sufficient welfare services or to have insufficient welfare services but a low burden.

Special measures for the effects of the COVID-19

The Ministry of Finance has announced a special system to defer the payment of national tax for one year for those who have lost their jobs or their income has been decreased sharply due to the COVID-19.People who satisfy the following conditions are eligible.

①Due to the effects of the COVID-19, income from business activities has decreased by more 20% compared to the corresponding period of the previous year for any period (one month or more) since February 2020.

②Difficulty in paying taxes in a lamp.

POINT

・Japan is a "medium welfare with medium charges" country.

・Due to the influence of the COVID-19 ,those who meet the conditions will be allowed to defer payment of national taxes.