Obligation to pay taxes

International comparisons

Consumption Tax

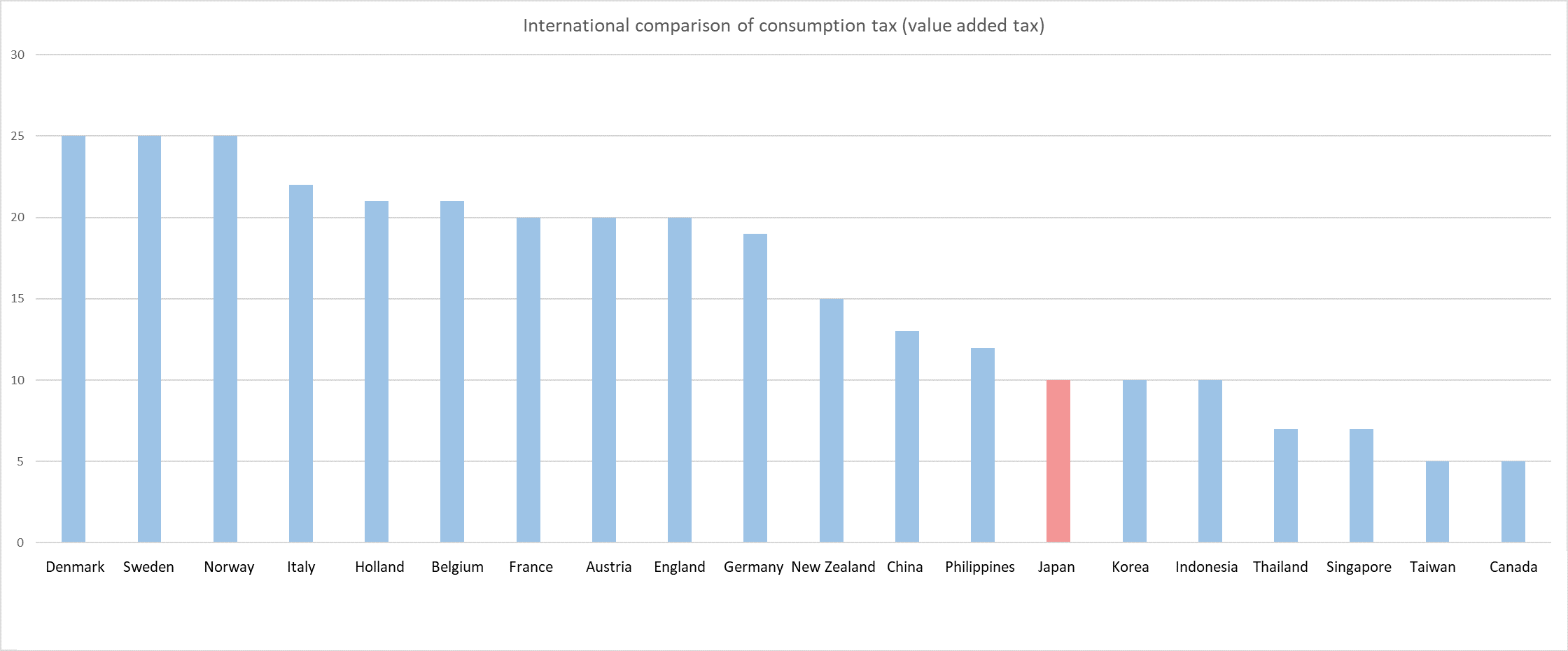

In Japan, the consumption tax has been raised every year, and when you hear 10%, it seems very high.

However, the graph above shows that Japan's consumption tax rate is relatively low compared to other countries in the world.

Other foreign taxes

- 〈Soda tax〉 This tax was created by the World Health Organization (WHO) when it called on member countries and regions to tax on beverages that contain a lot of sugar in order to curb lifestyle-related diseases and obesity in children.

- 〈Degree tax〉 Australia's degree tax is a tax on degrees awarded upon graduation from university.

- 〈Shibboleth tax〉 The system was introduced in February 2003 to improve traffic conditions and the public transportation system in London, which had been suffering from chronic traffic congestion.

Not only sweetened carbonated beverages, but also beverages that contain a lot of sugar (sports drinks, iced coffee, juice with fruit juice, carbonated water, etc.) are taxed.

The world's first soda tax was introduced in France in January 2012 with a tax of about 1 yen per can of sugar-sweetened carbonated beverage.

In Mexico, where more than 70% of adults are overweight and 32% are obese, a sugar-sweetened beverage tax of about 5.5 yen per liter has been introduced.

It was also introduced in the city of Philadelphia, Pennsylvania, USA.As a result, fewer people bought such beverages, which attracted more attention.

In Australia, most universities are national and tuition fees are covered by the government.

That's why students pay tuition fees in the form of a degree tax, and that funding is used to run the university.

A degree tax of 3-6% is collected depending on income after graduation, and the higher the income, the higher the tax.

The system is designed so that there is no inequality in education between the rich and the poor, as there is no tax if the income is low and the income does not meet certain conditions.

It requires a charge when driving through a predetermined Shibboleth tax zone, and it applies not only to residents but also to foreign tourists.

The introduction of this system has resulted in a 30% reduction in traffic congestion and a 15% reduction in traffic volume in London.

However, some users are unhappy because of the continuous increase in taxes and the lack of improvement in the public transportation system.

POINT

・Japan's standard rate of consumption tax (value-added tax) is relatively low in the world.

・There are many unique tax systems in the world, and many of them represent the characteristics of their countries.